Sometimes you may end up in want of a small amount of cash, like $500, to cowl unexpected bills or bridge a short-term financial hole. In such conditions, obtaining a $500 mortgage can present the necessary reduction. Here’s a information on tips on how to get a $500 mortgage quickly and easily.

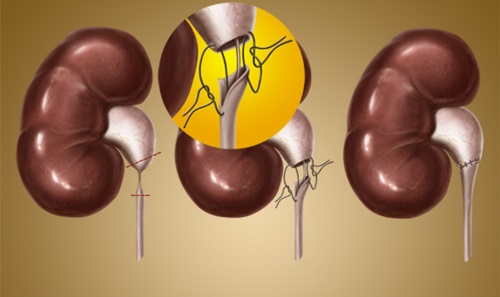

A home equity mortgage, also recognized as a second mortgage, is a lump-sum mortgage that makes use of the equity in your house as collateral. Equity is the distinction between the market worth of your house and the outstanding steadiness of any present mortgages or liens.

A home equity mortgage is a sort of mortgage that permits householders to borrow in opposition to the equity they have built up in their property. This article will explain what a house fairness mortgage is, the way it works, its benefits, and important issues for debtors.

1. No True Guarantee:

Despite the time period «guaranteed,» there is not any such factor as a assured loan approval within the literal sense. All reliable lenders assess mortgage applications based on certain standards, such as creditworthiness, income stability, and compensation capability.

Loan agreements serve a quantity of functions:

— Clarity: Clearly outline rights, duties, and obligations of each events.

— Legal Protection: Provide authorized recourse in case of disputes or defaults.

— Regulatory Compliance: Ensure compliance with applicable laws and laws.

— Record Keeping: Serve as a report of the loan transaction for both events.

A Loan Express payday advance offers a convenient and accessible way to entry quick cash if you want it most. By understanding the features, benefits, and concerns of payday advances, debtors can use this financial device responsibly to handle short-term monetary needs effectively.

The agreement outlines conditions for default (e.g., missed payments) and potential remedies:

— Default Interest: Higher rates of interest utilized upon default.

— Repossession: The lender’s proper to seize collateral upon default.

While assured loan approval could appear to be a beautiful option for borrowers with challenging credit conditions, it’s essential to method such offers with caution and carefully evaluate the phrases and circumstances. By exploring various lending options and taking steps to enhance creditworthiness, borrowers can enhance their probabilities of securing affordable loans with favorable terms.

Once you have chosen a lending option, full the applying process both on-line or in individual. Be truthful and accurate in providing your data. After submitting your software, await the lender’s approval decision.

— Quick Approval: Since credit checks usually are not required, approval for these loans could be obtained swiftly, usually inside hours of utility.

— Online Application: Borrowers can conveniently apply for these loans on-line with out the need for in-person visits.

— Fast Fund Disbursement: Approved loan amounts are usually transferred electronically to the borrower’s bank account inside a short interval.

— Accessible to All Credit Profiles: Individuals with various credit scores, including these with no credit history or poor credit, can qualify for these loans primarily based on different monetary criteria.

— Quick Approval: It.euroweb.ro Loan Express payday advances function quick approval processes, usually offering instant decisions upon utility submission.

— Fast Disbursement: Once permitted, the mortgage amount is disbursed rapidly, usually within hours or by the following business day.

— Minimal Documentation: Compared to traditional bank loans, Loan Express payday advances require minimal documentation, simplifying the application process.

— Online Application: Borrowers can conveniently apply for payday advances online by way of the Loan Express web site or mobile app, making the process accessible from anywhere.

Guaranteed mortgage approval refers back to the promise made by some lenders that they may approve a loan software from virtually any borrower, regardless of their credit rating, earnings stage, or different financial factors. This assurance is often used as a advertising tactic to attract borrowers who could have difficulty obtaining loans from traditional lenders as a outcome of poor credit or limited credit score historical past.

— Immediate Access to Cash: Loan Express payday advances provide fast access to funds, making them ideal for urgent monetary wants.

— Convenience: The on-line software course of is convenient and may be accomplished inside minutes from the comfort of your home.

— Flexible Repayment: Loan Express offers flexible repayment choices tailor-made to suit your payday schedule.

— Accessible to All Credit Types: Loan Express considers candidates with various credit histories, making payday advances accessible to a broader range of debtors.